Summitpath Llp for Dummies

Summitpath Llp for Dummies

Blog Article

The 5-Minute Rule for Summitpath Llp

Table of ContentsFascination About Summitpath LlpThe Best Strategy To Use For Summitpath LlpThe 45-Second Trick For Summitpath LlpThe Greatest Guide To Summitpath LlpFacts About Summitpath Llp Uncovered

A management accounting professional is an essential role within an organization, but what is the function and what are they anticipated to do in it? ICAEW dives deeper in this management accounting professional overview. https://issuu.com/summitp4th. A monitoring accountant is a crucial duty in any type of organisation. Operating in the book-keeping or financing department, monitoring accountants are in charge of the preparation of management accounts and numerous various other records whilst likewise overseeing general audit treatments and techniques within the service.Recommending on the monetary effects of business decisions. Developing and managing economic systems and procedures and determining possibilities to enhance these. Overseeing accountancy specialists and support with common accountancy jobs.

Evaluating and taking care of threat within the organization. Administration accountants play a very crucial function within an organisation. Key economic information and records generated by administration accountants are used by senior monitoring to make enlightened service decisions. The analysis of business efficiency is a vital role in a monitoring accounting professional's task, this analysis is produced by checking out present monetary information and also non - financial data to figure out the setting of business.

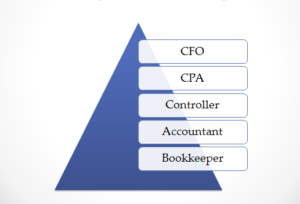

Any kind of service organisation with a financial department will certainly require a management accountant, they are additionally regularly utilized by banks. With experience, a monitoring accounting professional can expect strong job progression. Experts with the needed qualifications and experience can take place to become financial controllers, financing directors or primary monetary policemans.

The 8-Minute Rule for Summitpath Llp

Can see, examine and advise on alternating resources of company money and different ways of raising finance. Communicates and suggests what impact monetary decision production is carrying developments in law, ethics and administration. Assesses and recommends on the right methods to handle company and organisational efficiency in connection to service and financing danger while interacting the influence effectively.

Makes use of different cutting-edge methods to carry out strategy and take care of change - CPA for small business. The distinction in between both financial accountancy and supervisory accounting worries the desired users of info. Managerial accountants need service acumen and their purpose is to work as organization partners, aiding magnate to make better-informed choices, while financial accountants aim to create monetary documents to supply to external parties

The Main Principles Of Summitpath Llp

An understanding of business is likewise crucial for management accounting professionals, together with the capacity to connect efficiently whatsoever levels to suggest and communicate with elderly participants of staff. The responsibilities of an administration accounting professional must be executed with a high level of organisational and critical reasoning abilities. The ordinary wage for a legal monitoring accountant in the UK is 51,229, a boost from a 40,000 typical gained by management accounting professionals without a chartership.

Offering mentorship and leadership to junior accounting professionals, promoting a culture of cooperation, development, and operational excellence. Collaborating with cross-functional groups to create spending plans, projections, and long-lasting monetary approaches. Remaining notified about changes in audit guidelines and finest techniques, applying updates to internal procedures and paperwork. Must-have: Bachelor's degree in bookkeeping, financing, or a related field (master's liked). Certified public accountant or CMA certification.

Charitable paid time off (PTO) and company-observed vacations. Professional advancement possibilities, consisting of reimbursement for CPA certification expenses. Adaptable work choices, consisting of crossbreed and remote routines. Accessibility to wellness programs and worker help sources. To apply, please submit your return to and a cover letter describing your qualifications and rate of interest in the elderly accounting professional role. Bookkeeper Calgary.

Summitpath Llp Can Be Fun For Everyone

We're anxious to discover a proficient senior accounting professional ready to add to our company's monetary success. For inquiries concerning this position or the application process, call [Human resources get in touch with details] This job publishing will certainly expire on [day] Craft each area of your work summary to mirror your organization's special needs, whether employing a senior accounting professional, company accounting professional, or an additional expert.

A strong accountant work account goes beyond providing dutiesit clearly connects the credentials and expectations that find this align with your organization's requirements. Differentiate between necessary certifications and nice-to-have abilities to help prospects determine their suitability for the position. Specify any type of qualifications that are obligatory, such as a CPA (State-licensed Accountant) license or CMA (Qualified Monitoring Accountant) designation.

An Unbiased View of Summitpath Llp

Follow these best practices to develop a task description that reverberates with the ideal candidates and highlights the unique facets of the function. Accounting duties can vary widely depending upon seniority and specialization. Stay clear of uncertainty by describing specific jobs and areas of emphasis. For instance, "prepare month-to-month monetary statements and manage tax filings" is much clearer than "take care of monetary documents."Mention key locations, such as financial coverage, bookkeeping, or pay-roll monitoring, to attract prospects whose abilities match your requirements.

Accountants help organizations make important financial decisions and modifications. Accounting professionals can be liable for tax obligation coverage and declaring, reconciling balance sheets, assisting with departmental and organizational budget plans, monetary projecting, communicating findings with stakeholders, and much more.

Report this page